Please review the following important updates regarding the 403(b) and 457(b) retirement plans for the 2025 calendar year.

2025 Limit Increase

The IRS has announced cost-of-living adjustments (COLAs) for retirement plans, which means higher contribution limits for both the 403(b) and 457(b) plans.

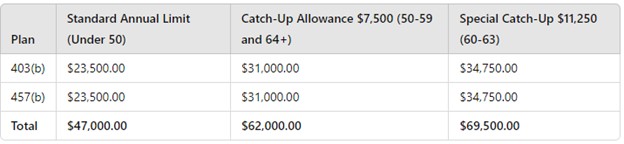

- New Annual Limit: Contributions for each plan will increase to $23,500, up from $23,000 in 2024.

- Catch-Up Contributions: The catch-up limit for individuals aged 50-59 and 64+ remains at $7,500.

- NEW for 2025: Individuals age 60-63 can take advantage of the $11,250 Special Catch-Up Contribution. This rule applies to anyone who will fall within this age bracket within the 2025 calendar year.

Contribution Adjustments

If you wish to maximize the new deferral limits, log in to TIAA PlanFocus and update your contribution rate to be effective for the beginning of the new calendar year. If no changes are made, your current contribution rate will remain in effect. In order for your salary deferral adjustment to take effect on your first check of the new year, you must make the change in TIAA PlanFocus by 12/20/2024. You can access the TIAA Plan Focus through your MyUAH page, under the Human Resources category.

Follow this link to view the TIAA Quick Guide, for instructions to enroll, change contributions, investments, and beneficiary designation. TIAA also provides retirement counseling; both on-campus and virtual individual counseling appointments are available with a financial advisor from TIAA. Click here to view the upcoming counseling sessions, or call TIAA at 800-732-8353, weekdays, 8 a.m. to 10 p.m. (ET).

Employer Match

The University offers a dollar-for-dollar matching contribution on voluntary retirement plans, up to 5% of salary for eligible exempt and professionals eligible for overtime (grandfathered) employees. Participants are immediately vested in the plan, providing full ownership of both their contributions and the University's matching contributions from day one.